Canadian Startup and Video Game Law Blog

Startup and video game law, from a Canadian and U.S. perspective

Categories

Moving to Canada

As a cross-border law firm, we focus on establishing Canadian companies for US (and other foreign) companies; often these cross-border structures are driven by remote teams and/or a desire to utilize certain Canadian tax credits. Our aim with this post is to detail the most common cross-border structure we create for our US clients (especially startups) to establish a Canadian presence and move some of their team to Canada.

1. Form Canadian Entity

First, a Canadian entity is formed, usually in the province where the company anticipates being based. Where there are employees living in multiple provinces, often we will recommend incorporating in the province in which most employees are based.

While Canada has a unique federal corporate structure, we do not recommend incorporating federally as: (i) federal companies are foreign in all provinces, resulting in the need to register the company in each province in which it has a presence and incurring additional legal costs and administrative hassle; and (ii) the board of directors of a federal company must have at least 25% Canadian residents, or if less than 4 directors, 1 must be a Canadian resident, a requirement that may be a challenge for a foreign company to meet.

2. Subsidiary or Affiliate

Second, we collaborate with our US client and their tax advisors on the best ownership structure for the Canadian company. Depending on the client’s needs and desire to utilize certain Canadian tax credits (a common ask for startups), the Canadian company may be a wholly-owned subsidiary or affiliate of the US company.

3. Intercompany Agreement

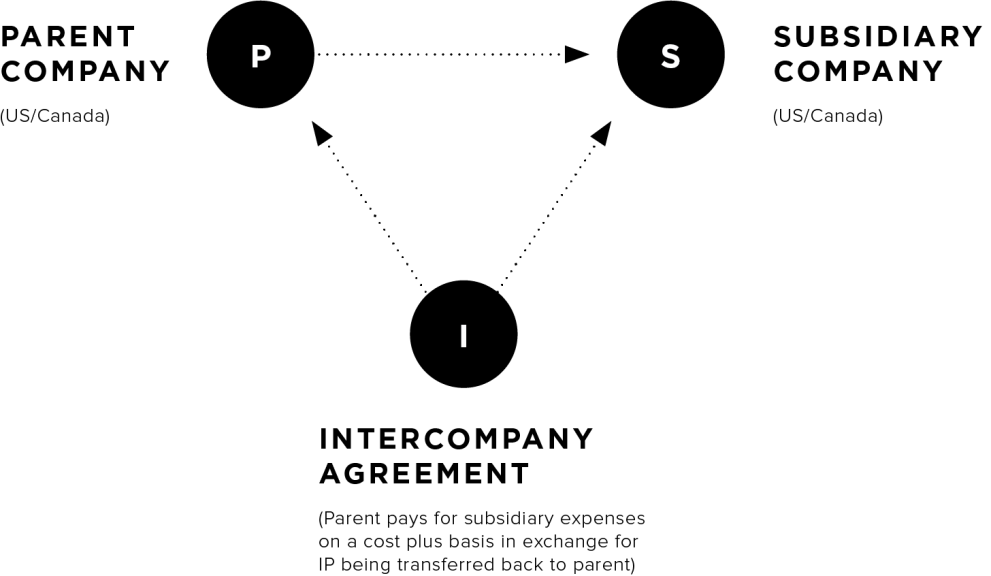

Third, we draft an Intercompany Agreement to address the relationship between the US company and Canadian company. While the two companies are related, they must treat one another on an arm’s length basis for tax purposes.

Effectively the Intercompany Agreement sees the US company paying Canadian company costs, with a % markup, in exchange for intellectual property created by Canadian employees being transferred back to the US company, as illustrated below:

4. Employment Agreements

Finally, we re-draft (Canadian-ize) the US company’s US Employment Agreement template to comply with Canadian laws, which Employment Agreement would then be used by the Canadian company to hire. Through this unique approach (uncommon among law firms) we ensure that the Canadian employment agreement is as close as possible to the US company’s, allowing for substantial contractual consistency between jurisdictions.

If you’re looking to setup Canadian operations for your US company, please reach out to the Voyer Law team and we would be glad to discuss your options in-depth.